Introduction: Trends in SaaS-the Dynamic Landscape of 2024

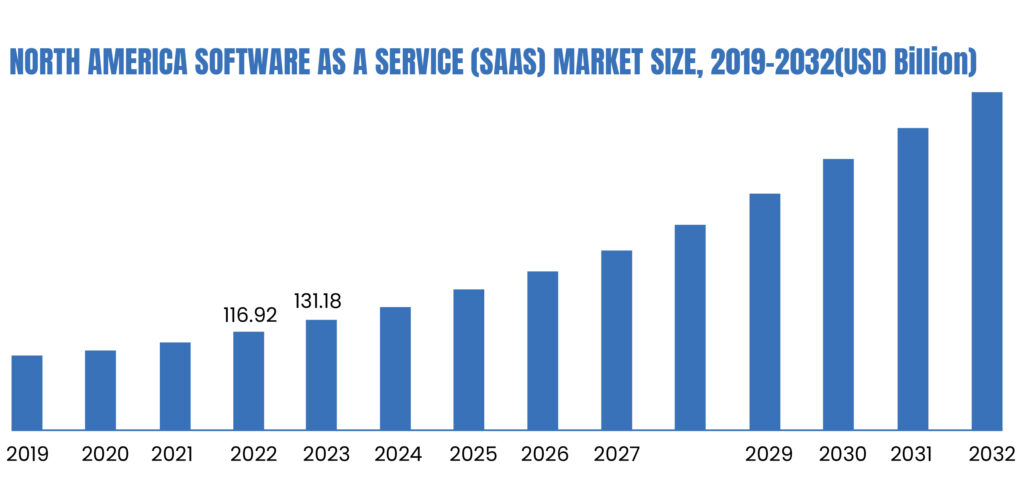

The Software as a Service (SaaS) industry continues to grow at an unprecedented pace. In 2024, advancements in technology, changing business needs, and evolving consumer behavior will drive new trends and create profitable opportunities for investors. This article explores the key trends shaping the SaaS market and provides actionable insights for investors looking to capitalize on these developments

Key Trends in SaaS to Watch in 2024

1. AI and Machine Learning Integration

Artificial Intelligence (AI) and Machine Learning (ML) are transforming SaaS applications. These technologies enhance software capabilities, offering advanced analytics, automation, and personalized user experiences. AI-powered tools for customer service, predictive analytics, and workflow automation are becoming essential components of modern SaaS solutions.

2. Rise of Low-Code/No-Code Platforms

The demand for low-code and no-code platforms is increasing as businesses seek to reduce development time and costs. These platforms enable users with minimal coding skills to create and deploy applications, fostering innovation and agility. They are particularly popular among small and medium-sized enterprises (SMEs) looking to digitalize rapidly.

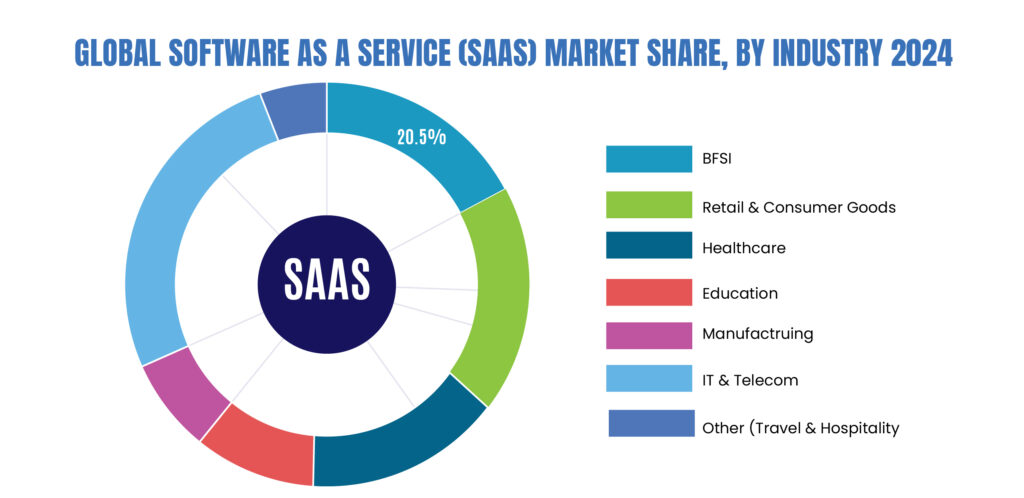

3. Vertical SaaS Dominance

Vertical SaaS solutions, customized for specific industries like healthcare, finance, and retail, are gaining traction. These niche products address unique industry challenges, offering specialized features and compliance capabilities. Investors are increasingly interested in vertical SaaS companies due to their potential for higher customer retention and market penetration.

4. Increased Demand for Collaboration Software

With remote and hybrid work models becoming the norm, collaboration tools are in high demand. SaaS applications that facilitate communication, project management, and virtual meetings are essential for maintaining productivity and connectivity in distributed teams. Products like Slack, Zoom, and Microsoft Teams are leading the way.

5. Integration Platform as a Service (IPaaS) Enhances Connectivity IPaaS solutions are crucial for integrating various SaaS applications and data sources. They enable smooth data transfer and compatibility between disparate systems, enhancing overall business efficiency. As businesses adopt more SaaS applications, the need for strong integration platforms will continue to grow.

6. SaaS Companies Focus on Reducing Churn Customer retention is a critical metric for SaaS companies. To reduce churn, companies are investing in customer success teams, implementing advanced analytics to predict churn risks, and enhancing user engagement through personalized experiences. Effective staff management strategies are essential for maintaining growth and profitability.

7. ESG Reporting Software Growth Environmental, Social, and Governance (ESG) considerations are increasingly important for businesses. SaaS applications that provide ESG reporting and compliance tools are in high demand. These tools help companies track and report their ESG performance, meeting regulatory requirements and investor expectations.

8. SaaS Security Concerns As cyber threats become more sophisticated, the need for robust security measures in SaaS applications is paramount. SaaS providers are investing heavily in advanced security features, such as encryption, multi-factor authentication, and real-time threat detection, to protect sensitive data and maintain customer trust.

9. Alternative Pricing Strategies Subscription-based pricing models are evolving. SaaS companies are experimenting with alternative pricing strategies, such as usage-based pricing and tiered subscription plans, to attract a wider range of customers and increase revenue flexibility.

Emerging Investment Opportunities in SaaS

Identifying High-Growth Areas

Investors should focus on SaaS segments with high growth potential, such as AI-driven applications, low-code platforms, and vertical SaaS solutions. These areas are expected to see significant demand in the coming years.

Key Performance Indicators (KPIs) for SaaS Investments

Investors should consider KPIs such as Annual Recurring Revenue (ARR), Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), and churn rate when evaluating SaaS investments. These metrics provide insights into a company’s growth potential and financial health.

Predictive Analytics for Investment Success

Leveraging predictive analytics can help investors identify promising SaaS startups and trends. By analyzing market data, customer behavior, and industry trends, investors can make informed decisions and mitigate risks.

Case Studies: Successful SaaS Investments

Case Study 1: Zoom

Zoom’s rapid growth during the pandemic is a prime example of successful SaaS investment. Its user-friendly interface, reliability, and ability to scale quickly made it a go-to solution for remote work and virtual meetings. Investors who recognized Zoom’s potential early on saw substantial returns.

Case Study 2: Salesforce

Salesforce’s dominance in the CRM market demonstrates the value of investing in vertical SaaS solutions. Its continuous innovation, robust ecosystem, and customer-centric approach have solidified its position as a market leader, delivering strong returns for investors.

Expert Opinions and Future Predictions

Interviews with Industry Leaders

Let’s explore the perspectives of two influential CEOs:

Satya Nadella, CEO of Microsoft

- AI and Cloud Computing: Under Satya Nadella’s leadership, Microsoft has witnessed remarkable growth driven by cloud services, acquisitions, and AI. Microsoft Azure, the cloud computing platform, has become a global leader, with 95% of Fortune 500 companies relying on it for trusted cloud services. Nadella emphasizes infusing AI across every layer of technology to drive productivity gains and win new customers. Azure’s AI capabilities have expanded significantly, with 53,000 Azure AI customers and a focus on “models as a service.”

- Future Outlook: Nadella believes that AI and cloud computing will play a decisive role in the future. Microsoft aims to democratize access to large AI models and address emerging market needs.

Marc Benioff, CEO of Salesforce:

- Innovation-Driven Growth: Marc Benioff founded Salesforce in 1999 with a vision to transform CRM using cloud-based solutions. Salesforce pioneered the Software-as-a-Service (SaaS) era, fundamentally changing how companies interact with CRM software. Key innovations include AppExchange (enterprise app marketplace), Salesforce1 (mobile CRM), and Einstein AI (democratizing AI within CRM). Strategic acquisitions have expanded Salesforce’s offerings beyond traditional CRM.

- Customer-Centric Approach: Salesforce’s success stories highlight its dedication to customer satisfaction. Companies like Mercedes-Benz, NBCUniversal, and IBM have leveraged Salesforce for personalized marketing, optimized advertising, and streamlined sales processes.

- Formula for Success:

- Innovation Mindset: Salesforce stays ahead by foreseeing and adapting to market changes.

- Customer Obsession: Solving genuine business challenges fosters long-term loyalty.

- Ecosystem Development: AppExchange and partnerships offer unmatched flexibility.

These visionary leaders continue to shape the future of technology, emphasizing AI, cloud, and customer-centric innovation.

Predictions for the Future of SaaS Investments

Experts predict that AI and ML will continue to revolutionize SaaS applications, while security and compliance will remain top priorities. The adoption of low-code platforms will democratize software development, and vertical SaaS solutions will become more prevalent.

Conclusion:

Summary of Key Points

- AI and ML, low-code platforms, and vertical SaaS are key trends shaping the industry.

- High-growth areas and predictive analytics can guide investment decisions.

- Successful investments like Zoom and Salesforce highlight the potential returns in the SaaS market.

The Software as a Service (SaaS) industry is set for significant growth in 2024, driven by trends such as AI and Machine Learning integration, the rise of low-code/no-code platforms, vertical SaaS solutions, and increased demand for collaboration software. Additionally, IPaaS, efforts to reduce churn, ESG reporting software, SaaS security concerns, and alternative pricing strategies are critical factors influencing the market.

For investors, focusing on high-growth areas like AI-driven applications, low-code platforms, and vertical SaaS solutions can yield substantial returns. Key Performance Indicators (KPIs) such as Annual Recurring Revenue (ARR), Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), and churn rate are essential for evaluating growth potential and financial health. Leveraging predictive analytics can further enhance investment success by providing insights into promising startups and market trends.

Case studies of successful investments like Zoom and Salesforce demonstrate the potential returns in the SaaS market. Expert opinions and future predictions highlight the ongoing revolution in SaaS applications powered by AI and ML, the importance of security and compliance, and the democratization of software development through low-code platforms.

Actionable Advice for Leveraging Trends and Opportunities

- Stay informed about emerging trends and technologies.

- Focus on KPIs to evaluate investment potential.

- Leverage data and predictive analytics to make informed decisions.

What are the top trends in SaaS for 2024?

The top trends include AI and ML integration, the rise of low-code/no-code platforms, vertical SaaS dominance, increased demand for collaboration software, IPaaS, focus on reducing churn, ESG reporting software growth, SaaS security concerns, and alternative pricing strategies.

Why are vertical SaaS solutions gaining traction?

Vertical SaaS solutions are tailored to specific industries, addressing unique challenges and compliance needs. This specialization often leads to higher customer retention and market penetration.

What KPIs should investors consider for SaaS investments?

Investors should look at Annual Recurring Revenue (ARR), Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), and churn rate to evaluate a company’s growth potential and financial health.

How can predictive analytics help in SaaS investments?

Predictive analytics can help investors identify promising startups and trends by analyzing market data, customer behavior, and industry trends, enabling informed decisions and risk mitigation.

What makes Zoom a successful SaaS investment?

Zoom’s user-friendly interface, reliability, and scalability made it a popular choice for remote work and virtual meetings, resulting in substantial returns for early investors.